As someone who has been a controller for several companies, I can attest to how important the CFO role is in participating in the selection, implementation and utilization of an ERP software system. This is true because, of all company executives, CFOs usually have the broadest perspective on managing all company assets (inventory, accounts receivable, equipment, personnel and cash).

A simple way to think about the CFO’s importance in an ERP selection is to consider the humble balance sheet. When combined with the income statement, the balance sheet is the ultimate way to gain perspective on your company’s financial health and effective utilization of its resources.

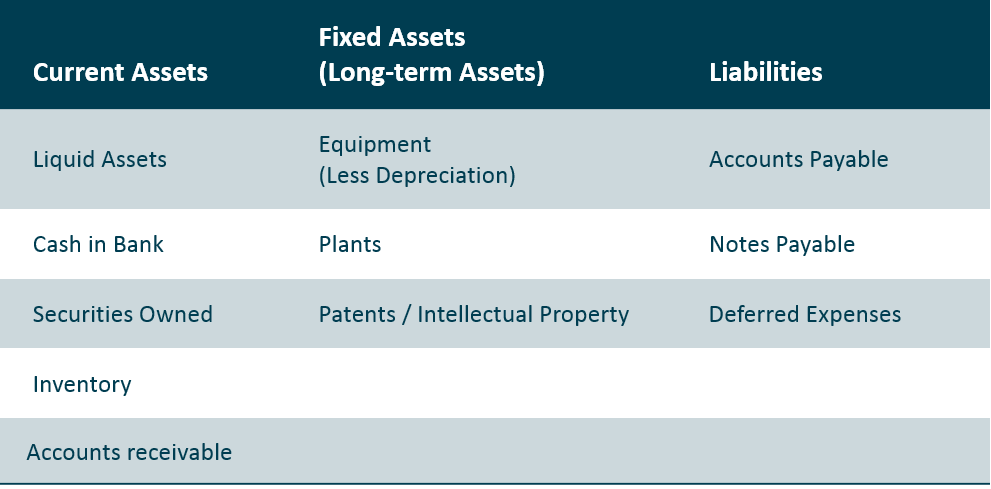

Here are the essential components of a balance sheet:

To determine your company’s equity (aka your company’s total capital or retained earnings), you use the equation below. Every year profit (or loss) from operations is incorporated into the balance sheet to show the increase or decrease in capital.

Equity = Current Assets + Fixed Assets + Investments – Current and long-term Liabilities

What does all this have to do with the CFO and an ERP system? Quite a lot as it turns out. The sharp CFO looks at the following items and thinks about how the ERP system will impact operations.

Quote-to-cash cycle

A typical quote-to-cash cycle in manufacturing is to receive a customer order for x amount of units or prospective customer request for a quote. A quote is prepared based on the cost of making the item plus overhead allocation and desired profit margin. The information for preparing the quote can be based on similar jobs which have been done in the past and retained by the ERP system.Once the quote is accepted by the customer, a product order is placed and materials are either pulled from inventory or ordered for that job. Once the job is completed and shipped, it is billed and cash is collected.The ability of the ERP system to support company processes from quote to cash with the minimum number of steps and maximum data access facilitates the quote to cash cycle.

Cash-on-hand

The end game of all transactions is cash. The faster the movement from inventory to production and/or delivery, the sooner cash is available to pay vendors and take advantage of discounts. It also can reduce the need to borrow which could result in a higher credit rating. Large organizations who deal with tens of millions of dollars will run a treasury management function where funds will be collected and aggregated by their financial accounting system to collect interest on short- and medium-term investments.

Of course, inventory is a management issue all by itself. The company needs the ERP system to help know when to order parts or raw materials so it can minimize inventory needed and still meet customer demand. ERP also can alert you when to order the quantity necessary to get larger discounts. This will require a robust purchase order (PO) system which alerts buyers when and how much to order, possibly based on a computer-generated forecast. An efficient approval system is another component so that orders are placed and tracked via system generated alerts to staff. Paperwork and filing is reduced when documents are generated and submitted to vendors and when inventory is received. Furthermore, the ERP system will have the ability to automatically check the vendor’s invoice for the correct price and quantity based on the PO, thus reducing the workload on staff to do it by hand. Electronic document management systems facilitate the preparation, authorization and filing of virtually any transactional document with customers or vendors. A modern ERP system will further support a paperless office by letting you scan vendor or customer source documents and record transactions without any manual keying of information.

Shop floor reporting

More and more manufacturing executives are interested in real-time data from the shop floor. Some ERP vendors offer an MES (Management Execution Systems) which provide real-time shop floor reporting for labor, production, quality and machine efficiencies. It’s all about being alerted to performance indicators as quickly as possible. A process that runs awry even for a few hours can kill the profits on a job.

- Supply chain: Efficiency and minimizing the cost of holding inventory as offshore sourcing becomes more widespread means that companies have to maintain careful control over vendor orders, in-transit shipping and cost factors. Manufacturers will often outsource their manufacturing to Asia but keep inventory management and customer ordering processes in-house. An ERP solution that supports outside contract manufacturing will have a portal where the primary manufacturer can track production and inventory and do the best job possible providing the necessary components or materials to their contract manufacturers to meet customer demand.As part of the supply chain challenge, Warehouse Management is a front and center issue. If the warehouse operation is large, multiple bin location tracking, bar code scanning and movement of inventory between locations must be carefully tracked. ERP systems that support specialized Warehouse Management functions are invaluable in this environment

- Customer satisfaction: Competition (think Amazon) is so stiff nowadays, companies have to be tuned into meeting customer expectations on delivery and quality. A capacity planning/available promise ERP application supports the ability to project when an order can be shipped by looking at the capacity of all available resources.

It’s about managing assets, control and productivity

I speak to many companies who simply refuse to move from their antiquated, almost paper and pencil, systems. Why? Because they feel they are making enough money and don’t need to put themselves through the pain of installing a new ERP system. This is understandable. Unfortunately, the day of reckoning eventually comes when they have no choice but to change. The CFO has a responsibility to explain when and why the company should investigate a new ERP solution and make sure that management understands its potential bottom line benefits as well as the risk of not making that ERP investment. Another way to look at it is, unless you all plan to retire soon and close up your business, your skilled (and ambitious) staff is going to look for greener pastures at companies that can help them be more efficient at their jobs and stay current with the skills needed to stay employed until they are ready to retire.

Summary

Of all company employees the CFO, as well as the CIO in larger companies, will likely be most attuned to the benefits of a new, effective ERP solution. This is because everything a company does ultimately flows to the bottom line and it’s his or her job to prepare the financial reports. A modern ERP system that is used effectively by well trained, motivated staff will result in reduced costs, higher profits and more satisfied customers which are the end goals of any company.

About the author

Sheldon Needle is President of CTSGuides – the first company to do independent research and evaluations of mid-market solutions for accounting, manufacturing and construction. His services have been used by Microsoft, IBM and Salesforce.com, among others. For more information, see http://ctsguides.com.